Customised solutions developed for each organisation’s requirements.

Tailored to enhance your business in the way that best suits you.

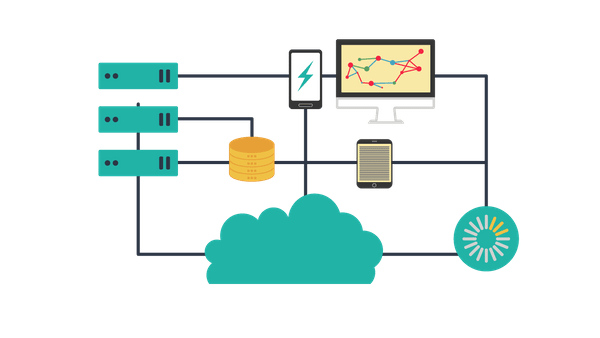

AI & Big Data Framework

- Transform from the digital era to the intelligence era. Such initiative requires an organisation-wide ICT infrastructure change and can be arduous.

- IT infrastructure ready to handle external and unstructured data analysis• Organisation wide capability to run AI application

- Improve efficiency and efficacy on your business and decision processes

Bond Management & Risk Evaluation

- Traditional methods of due diligence and risk evaluation are no longer adequate for today’s dynamic market movements. The negative impact from errors and damaged reputation today are harder to rectify.

- Monitor and flag events, occurrences in real-time basis, using non-traditional data source

- Automation in information extraction reduces human error & subjectivity

- Incorporate traditional & non-traditional data source to enrich evaluation process

Multi-sources Learning for Asset Ranking

- Utilise both traditional & non-traditional data sources to conduct asset performance evaluation and enrich predictive modelling.Build relational knowledge to strengthen evaluation capabilities with asset ranking deep learning model. Multiple data source learning creates holistic and faster market prediction as compared to traditional methods;

- AI-based investment assessment lacks subjectivity and have real-time capabilities;

- Predictive modelling is trained continuously to enable improvement in accuracy and predictive capabilities

User Profiling & Recommendation

- Understand your customers with more than just through internal data. Identify lifestyle, interests, product affinity and risk appetite of your customers.

- Deploy user profiling to understand large number of customers with scalability

- Sell-in high value products; Match life events against required products